This photo is circulating over linked in and Twitter since last week.

I was least surprised. I follow Entrackr and daily they send 3 startup’s news. One of them will be the financial breakdown of these heavily funded companies.

What surprised me was – the Aam junta were taken back by surprise. Many could not believe their eyes. They were asking for the poster for the source of this information – as if it was fake news.

Dunzo is a classic example. Many in Bangalore have used it and love dunzo. But they never think if it is a sustainable business. It will never be.

Uber – the one who started it all has publicly stated that they will never be profitable. I just checked – they listed at 42$ and now at 58$.

Perhaps the loss doesn’t matter anymore? Tomorrow Zomato is going IPO. Till now Indian stock markets rewarded profitable companies and punished loss making ones.

Perhaps the trend will change? Zomato’s stock price will go up and it will be kept there by punters and MF companies. The rest in the list will join – and they will just be played around via speculation – while these companies continue to make loses.

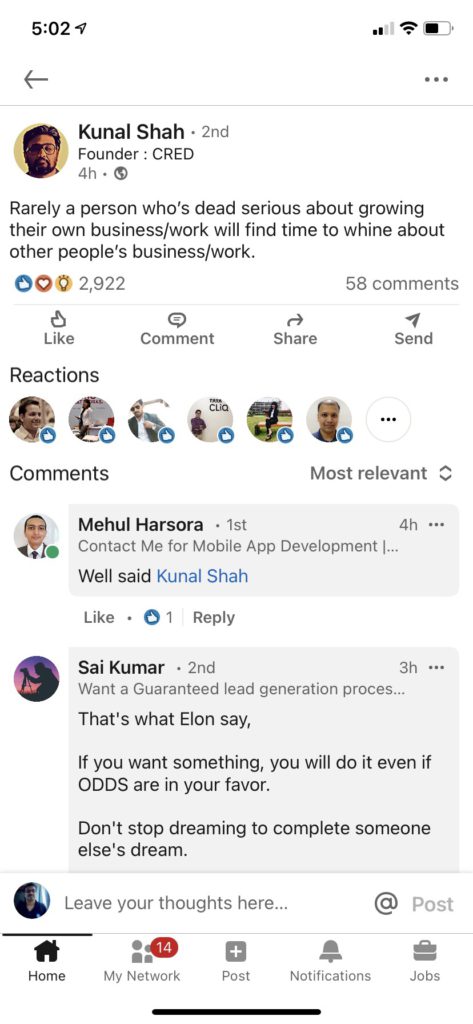

“Cred” being the first in list, got ridiculed a lot and Kunal Shah the founder of Cred got angry and posted this

That was yesterday. Today news was in news because they had raised $200 million at a valuation of $2.2Billion from $800 Million.

Now this wants me to ask a fundamental question – how much of this money is “theory” like bitcoin! If we add up all the money in the world – will it translate to the gold held in each country?

No?

If so – what is the multiple then? That is lets say – if US holds 100 Trillion Gold bars lets say – the total dollar money in the world = 10000 Trillion – so a multiple of 100.

What is the multiple if we add INR, Yen, Yuan etc.? Wouldn’t it be an astronomical number?

Anyway – there is too much paper money – in fact I don’t think there is paper money – it is all digital. Just like bitcoin. The $s are all digital.

The VC companies get their money from LPs.

The LPs get their money from other returns from VC investments

The returns from VC investments are obtained when VCs get an exit

And this has mushroomed bigger and bigger – perhaps the initial investment did start with some paper money.

I am just too brain fried right now. I am not an economist. I do not understand this angle of startups.

I believe in plain vanilla business. See a problem, create a solution, sell the solution, ask money for it, sell, support, rinse, repeat.